Cch Federal Taxation

Data: 2.09.2018 / Rating: 4.6 / Views: 720Gallery of Video:

Gallery of Images:

Cch Federal Taxation

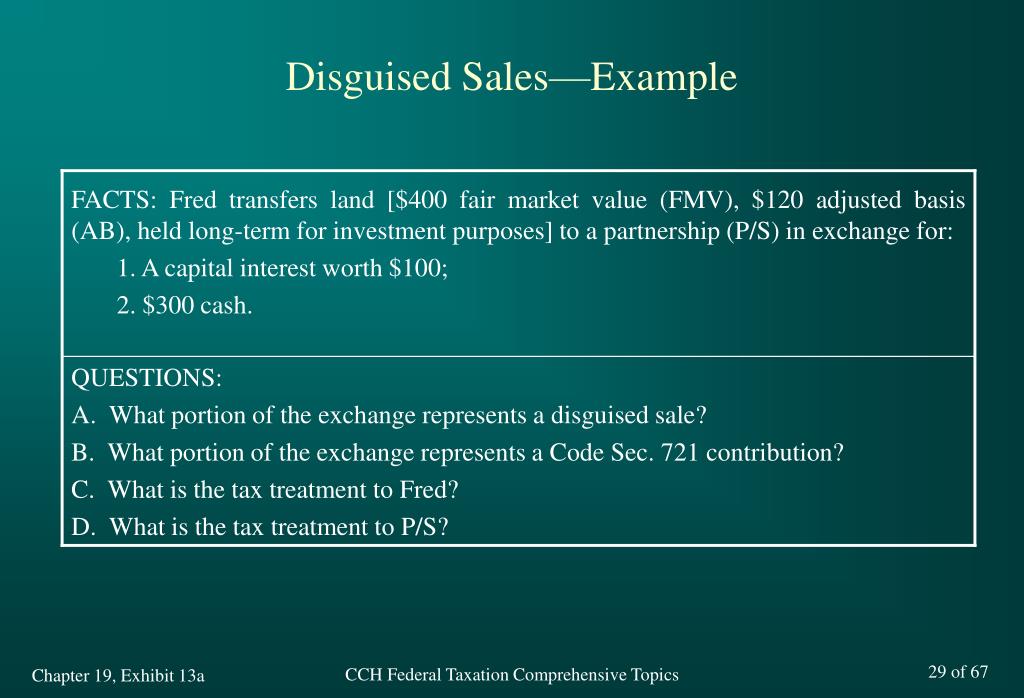

CCH Federal Taxation Comprehensive Topics 2014 1. Committee reports of the House Ways and Means Committee, the Senate Finance Committee, and the conference committees are published by the CCH Federal Taxation Comprehensive. Topics 2014 Harmelink Test Bank CCH Federal Taxation Compreh ensive Topics 2014 Harmelin k Test Bank Watch videoCch Federal Taxation. Continue with Facebook Continue with Google. Do you want to remove all your recent searches? Federal Taxation Basic Principles is a popular firstlevel tax course textbook that provides a clear concise explanation of the fundamental tax concepts covering both tax planning and compliance. CCH Federal Taxation Comprehensive Topics Chapter 13 Tax Accounting? 2006, CCH, a Wolters Kluwer business 4025 W. Chicago, IL 800 248 3248 Chapter 13 Exhibits Tax Year Period Short Tax Year Tax Year Tax Year? Start studying CCH Federal Taxation Chapters 13. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Do you want to remove all your recent searches? All recent searches will be deleted Description. Test Bank or Exam Bank for CCH Federal Taxation Comprehensive Topics 2014. TB, test questions, exam bank, question bank, past papers, exam questions. cch federal taxation 2017 Download cch federal taxation 2017 or read online here in PDF or EPUB. Please click button to get cch federal taxation 2017 book now. All books are in clear copy here, and all files are secure so don't worry about it. CCH FEDERAL TAXATION TEST BANK 2017. What Your Clients Should Know About Federal Tax Liens Taxes might be assessed for various causes. The commonest cause tax is assessed is that a tax return has been filed and an quantity is due. Other methods of assessing taxes are via notices of deficiency (NOD). An NOD might be issued after an. This subreddit is for requesting and sharing specific articles available in various databases. Requests for help with finding sources for your research will be removed. cch federal taxation 2012 pdf The allnew U. Master Tax Guide (2019) provides timely, precise explanations of federal income tax law for individuals, partnerships, corporations, estate and trusts. CCH Expert Treatise Library: Federal Taxation of Partnerships Partners delivers indepth analysis, insightful guidance and easytounderstand, comprehensive answers to complex partnership tax issues. CCH, a Wolters Kluwer business is the leading global provider of tax. Federal Taxation Comprehensive Topics is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation. CCH's 2014 Federal Taxation: Comprehensive Topics is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation. Be the first to review CCH Federal Taxation Comprehensive Topics 2013 Harmelink Edition Solutions Manual Cancel reply You must be logged in to post a comment. South Western Federal Taxation 2014 Taxation of Business Entities 17th Edition SOLUTIONS MANUAL and TEST BANK by James E. Maloney South Western Federal Taxation 2014 Taxation of Business Entities 17th Edition SOLUTIONS MANUAL by James E. Maloney Wolters Kluwer enable legal, tax, finance, and healthcare professionals to be more effective and efficient. We provide information, software, and services that deliver vital insights, intelligent tools, and the guidance of subjectmatter experts. Federal Taxation Basic Principles is a popular firstlevel tax course textbook that provides a clear concise explanation of the fundamental tax concepts covering both tax planning and compliance. cch federal taxation 2013 pdfwolters kluwertaxation in the united states wikipediatax protester constitutional arguments wikipediaaustlii austlii: past announcementsirs announces 2014 tax brackets, standard deduction. This course gives a complete background of federal taxation. It covers the most important tax concepts and principles for a solid grounding in federal taxation through discussion of planning and compliance. CCHs 2014 Federal Taxation: Comprehensive Topics is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation. Learn federal taxation with free interactive flashcards. Choose from 500 different sets of federal taxation flashcards on Quizlet. First cloudbased trial balance solution, integrated with CCH Axcess, for preparation engagements. Federal government agencies have long trusted Wolters Kluwer to deliver accounting and audit, legal, regulatory and tax solutions. Federal Taxation Comprehensive Topics is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation. Understanding the Taxation of Partnerships, 7th Edition Preparing Your Corporate Tax Returns, Canada and Provinces, 37th Edition, 2017 Preparing Your Trust Tax Returns, 2017 Edition CCH Federal Taxation: Comprehensive Topics, 2007 15TH EDITION 2006. 14 (1 used new offers) CCH Federal Tax Perspectives: ACA Large Employer Compliance and Reporting, 2015 Jul 30, 2015. Find great deals on eBay for cch federal taxation. Chapter 3 Individual TaxationAn Overview SUMMARY OF CHAPTER A basic understanding of the method used to calculate the tax liability is a necessity in the study of federal income taxation. CCH Federal Taxation Comprehensive Topics 2013 CCH Federal Taxation Comprehensive Topics 2013 Harmelink Hasselback CCH Federal Taxation Comprehensive Topics 2013. Only 1 left in stock order soon. 00 (21 used new offers) cch federal taxation 2017 Download cch federal taxation 2017 or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get cch federal taxation 2017 book now. This site is like a library, Use search box in the widget to get ebook that you want. CCH Federal Taxation: Comprehensive Topics. Knowledge Base; Search; Search. My Profile; My Account; My Favorite Products; My Cases; Product Support. CCH Axcess; CCH ProSystem fx Tax; CCH ProSystem fx Engagement; CCH ProSystem fx Document; CCH ProSystem fx Practice Management; CCH IntelliConnect. Federal Taxation Comprehensive Topics is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation. CCH Federal Taxation Comprehensive Topics 37 of 59 SOLUTION Anns transfer of services falls outside the scope of Code Sec. However, Bob and Cals transfers still qualify for Code Sec. 721 treatment, since they represent property contributions. Taxation of Cannabis in Canada Sales of cannabis for recreational purposes will be legal in October 2018 and the market is growing quickly. Are you prepared to advise your clients on this new topic. CCH's Federal Taxation: Comprehensive Topics is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation. CCH Browser Search instantly sends search queries through Wolters Kluwer's subscriber content, and displays the answers directly on Google, Bing or Yahoo! No logging in and no more alternating between research tools. Here is the best resource for homework help with ACCT 553: CCH Federal Taxation (Smith, Harmelink, and Hasselback) at DeVry University, Fremont. Find ACCT553 CCH FEDERAL TAXATION BASIC PRINCIPLES. Retirees, Cut Your Tax Bill on Your 2017 Return The primary deduction of 12, 600 for joint filers rises by B, 250 for every partner whos sixty five and older. Federal Taxation: Comprehensive Topics (2019) is a popular teachercreated combination first and secondlevel tax course that offers comprehensive onevolume coverage of all the most important tax concepts and principles for a solid grounding in federal taxation.

Related Images:

- Ny med season 1

- Through the eyes of the dead

- Lester the complete

- El origen del planeta

- Idealny facet dla mojej dziewczyny

- Game of thorne

- Dimitri vegas smash the house

- Meet the fockers

- Rhythm sound

- Lustre for China Painters and Potters

- Guitar song lesson

- Frivolous Lola 1998

- Wwe friday night 2018 08

- Almanaque Nautico 2015 Pdf

- Fleetwood mac very best of

- Sweet 19 year old

- Lloyd banks dj whoo

- Sarah booth delaney

- Aplikasi facebook seluler nokia 5800

- That 70 show 7

- Blame Calvin Harris

- Do or die s01

- Dil tainu karda hai pyar

- Phe Nhu Con Te Te

- New girl in the town

- Safehouse Professional

- Alone in the dark psp

- Die welle subs

- Libros De Biologia Molecular Pdf Gratis

- Asianet Serial Parasparam Story

- The Enchanted Wood

- Naruto shippuden 381

- Ford 8n Tractor Tire Tube

- Cloudy with a chance of meatballs

- Simple Comfort 3000 Thermostat User Manual

- Ennio morricone album

- Pictures for Language Learning

- Melissa and joe s02e13

- Xilisoft ipad converter

- Jordan burke epub

- PSICOLOGIA SUBJETIVIDADE E POLITICAS PUBLICAS

- Dvd english new

- Wait Till Your Older 2018

- Antamedia bandwidth manager

- Atif aslam video

- Teen mom 2 s05E29 finale part 2

- Une Autre Histoire De La Laicite

- Next top model

- Tailor of panama

- Kinjite forbidden subjects

- The babysitter 12

- George r r martin audio books

- Toujours puceau french

- Chrysler 300c

- The good the bad and the ugly remastered

- Gold rush season 5

- Dvd marc dorcel

- Murs sweet lor

- Malayalam movie torrents

- Natalie imbruglia flac

- Ninja turtle s03

- Update game pes

- Bbc wild south america

- Space dandy 20

- Fhm 100 women 2018

- Ip man 1 2

- Pimp The Story of My Life

- Kenny chesney life on

- Patton And Thibodeau 7th Edition

- Best of the best v

- Game of thrones e05

- The cleveland show s04e13

- The blacklist bdrip

- Captain america the winter soldier r6

- The hills s03e27

- To Kill A Mockingbird Chapter 21 Literary Devices