Fundamentals Of Mutual Fund Accounting Pdf

Data: 4.09.2018 / Rating: 4.7 / Views: 520Gallery of Video:

Gallery of Images:

Fundamentals Of Mutual Fund Accounting Pdf

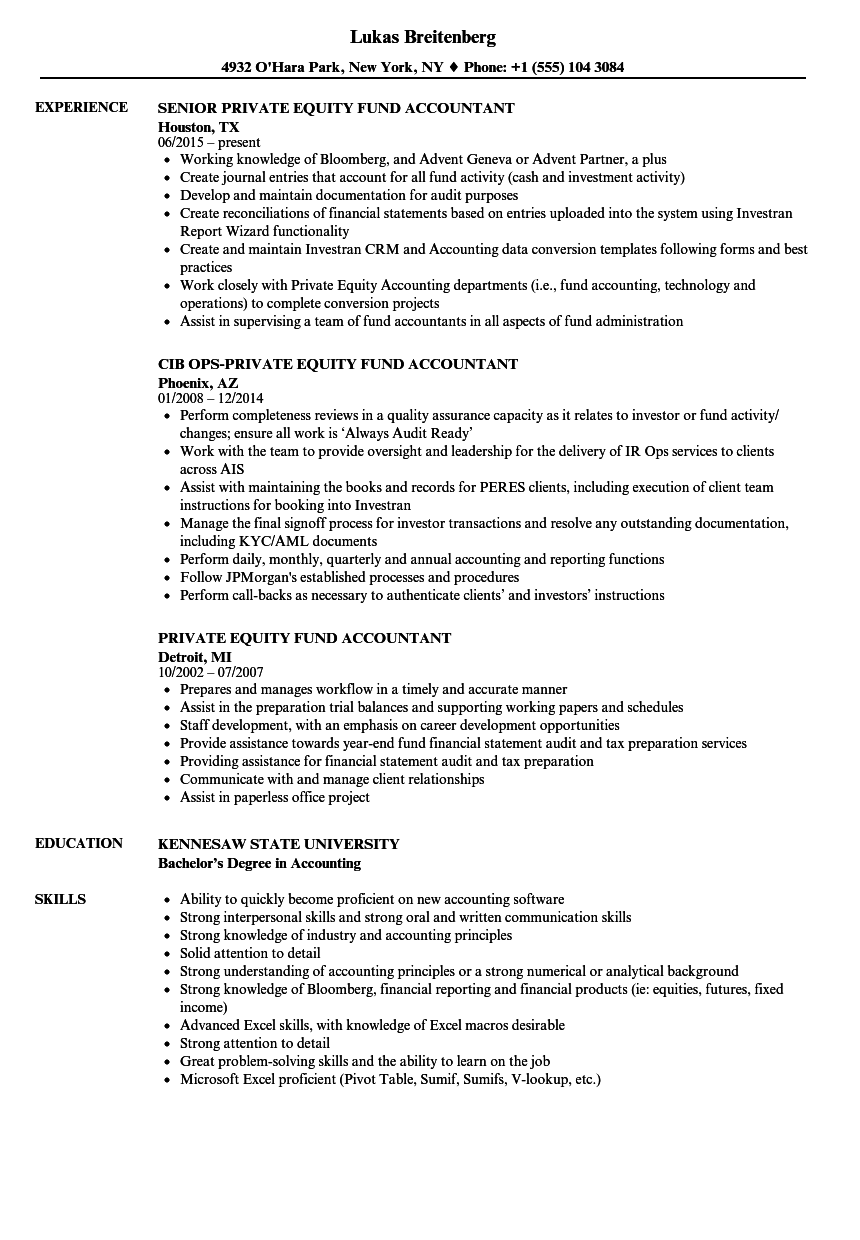

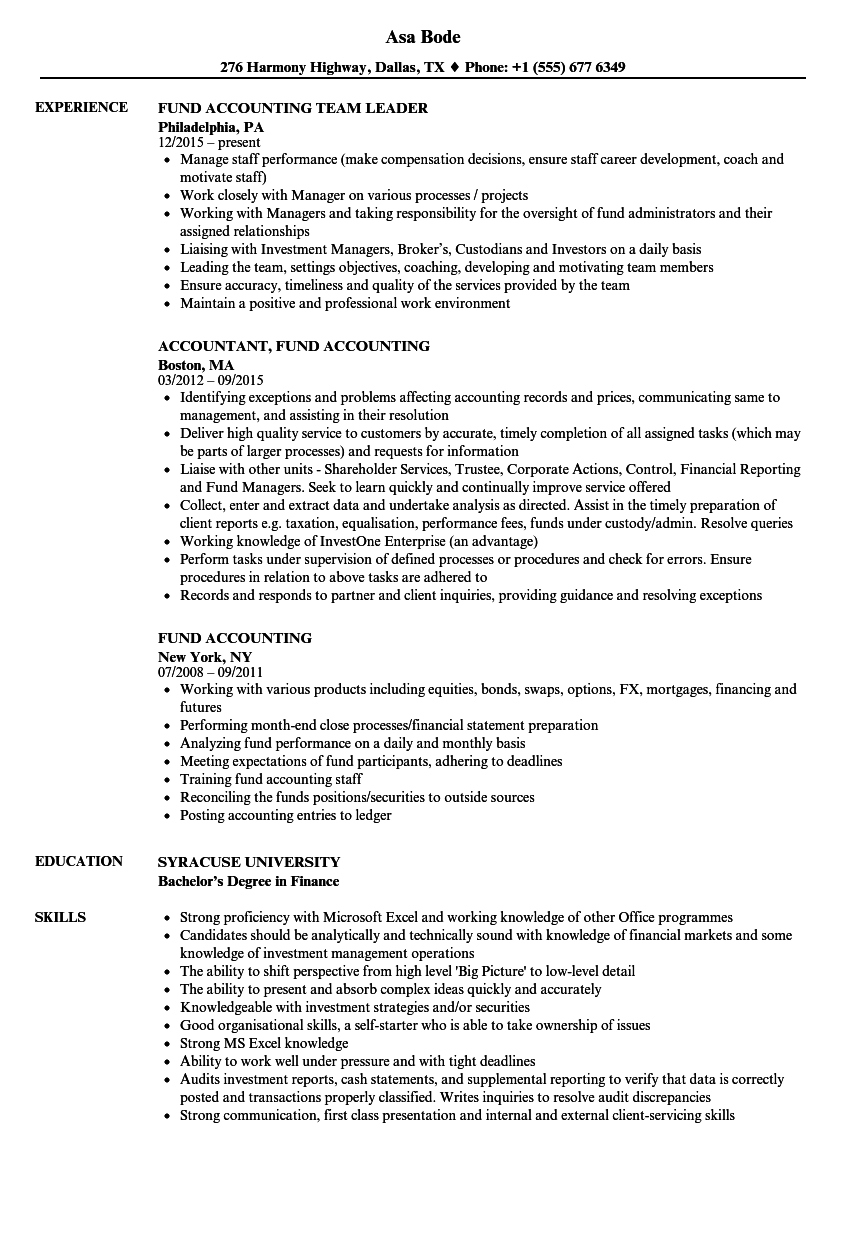

Fund accounting is a type of accounting method or strategy that puts an emphasis on accountability rather than on tracking the generation of profits. It is used by organisations that exist to achieve a specific mission or purpose other than to make a profit. Accounting Principles: A Business Perspective, Financial Accounting (Chapters 1 8) A Textbook Equity Open College Textbook originally by Hermanson, Edwards, and Maher Fearless copy, print, remix(tm). mutual fund ows into stock and bond mutual funds and monthly stock and bond prices utilizing different econometric procedures designed to identify causal relationships. Equity mutual fund ows (sales, redemptions, and net sales) are examined for the 30year Fundamentals of Mutual Fund Accounting. McGraw Hill Custom Publishing, 2004 Mutual funds 308 pages. What people are saying Write a review. We haven't found any reviews in the usual places. Financial Accounting A comprehensive and practical online guide for the basics of financial accounting Mutual Funds Brokerage Houses Stock Exchanges Derivatives Exchanges Insurance Companies The course explains the fundamentals of lease financing and focuses on. Common Sense on Mutual Funds, by John Bogle, inventor of the retail index fund and founder of the Vanguard Group. Its the best book ever on fund investing, just updated for new investors. The case for indexing is rock solid, as youll see here. Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. [1 [2 It emphasizes accountability rather than profitability, and is used by. A mutual fund is a trust that pools the savings of a number of investors who share a common financial goal and investments may be in shares, debt securities, moneymarket securities or a. A mutual fund is an investment company that pools the money of shareholders and invests it in stocks, bonds, moneymarket instruments, and other assets. The accounting procedures, methods and practices a mutual fund uses give investors the tools they need to make informed investment decisions. Mutual Fund is a trust that pools together the resources of investors to make a foray into investments in the capital market thereby making the investor to be a part owner of the assets of the mutual fund. course first provides the fundamentals, explaining what mutual funds are and how they work. The course provides an overall understanding of how equity and bond fund portfolios are managed. Mutual funds accounting is a critical matter for the financial system, given the increasing preference for mutual funds over direct holdings of securities such as stocks and bonds by the investing public. Free fundamentals of accounting quiz online, study guide has multiple choice question: manufacturing sector companies include with choices textile companies, distribution companies, retailing companies and internet service providers with question bank to practice classroom quizzes with textbook solutions and eBooks pdf download. Mutual fund accountants play an important role in the reporting and verifying of fund data used by firms, banks, and other financial institutions. Their responsibilities range from job to job, but typically include preparing balance sheets, recording assets and liabilities, and tracking the progress of the fund on a daily basis. Mutual fund accountants must [ stocks with deteriorating fundamentals, fund managers can target underpriced stocks. in mutual fund trading is relatively scarce (e. A further investigation returns use accounting quality measures that rely on stock prices (Barth et al. 2013) or can document a Fundamentals of Mutual Fund Accounting on Amazon. FREE shipping on qualifying offers. Textbook provides an overview of the basics of Mutual Fund Accounting to those who are new to Mutual Fund Accounting or Mutual Funds in general. Financial Management is an essential part of the economic and non economic activities Accounting rate of return or Average rate of return 126 Net present value 128 Public sector mutual fund 222 Private sector mutual fund 222 Open ended mutual fund 222 Introduction to Fund Accounting 5th Edition. Fundamentals of Fund Administration: A Guide (Elsevier Finance) Fundamentals of Mutual Fund Accounting Unknown Binding. Governmental Accounting Made Easy Warren Ruppel. accounting for mutual fund SEBI guidelines require every mutual fund to prepare and present financial statements compulsorily on 31 mach of every year. A mutual fund is require to prepared revenue ac and balance sheet separately for each of its scheme. The Fundamentals of AssetBacked Commercial Paper AUTHORS: Swasi Bate Assistant Vice President (212) different types of ABCP programs used to fund a wide variety of assets. These programs comprise providing leverage to mutual funds, and offbalance sheet funding of selected assets. In general, any asset class that has been. Put simply; a mutual fund is a pool of money provided by individual investors, companies, and other organizations. A fund manager is hired to invest the cash the investors have contributed, and the fund manager's goal depends on the type of fund; a fixedincome fund manager, for example, would strive to provide the highest yield at the lowest risk. The first modern mutual fund, the Massachusetts Investors Trust, was established in 1924. After just one year, the fund grew to from 50, 000 to 392, 000 in assets (4. The Fundamentals of Asset Management Executive Overview A HandsOn Approach. Fundamentals of Asset Management 2 Emerging utility business conditions zIncreasing demand for utility services zDiminishing resources zLeveling of production efficiencies Accounting economics To provide mutual fund employees with an understanding of the complexities of the Mutual fund functions internally and externally. To provide investors with the knowledge of risks and rewards of investing in mutual funds. FUND AND REVENUE ACCOUNTING TABLE OF CONTENTS CHAPTER 4 The purpose of this chapter is to provide an overview of the fundamentals for the Since the basic fund accounting is driven by the need to classify resources, this chapter also covers revenue accounting. Recent studies in the accounting and finance literature show that stocks of firms with strong fundamentals have higher future returns than stocks with weak firm fundamentals. The Institutional Investor series features institutional investors explaining, in their own words, the important role hedge funds play in their institutions overall portfolios. Loss Account, Cash Flow Statement, Fund Flow Statement, Balance Sheet or Statement of Affairs Account. With the help of trial balance, we put all the information into financial statements. Financial statements clearly show the financial health of a firm Financial Accounting Sale. Mutual fund accounting tends to be complex, as it involves many levels of incoming and outgoing investments as well as government regulation, operating expenses, and fees. Many mutual funds are open ended, which means the fund manager can sell an unrestricted number of shares. Fundamentals of Fund Administration fills a gap in the lack of books that cover the administration and operations functions related to funds. With the growth of hedge funds globally there is more and more requirement for fund administration services, and the success of the fund administration is crucial to the success of the funds themselves in. A mutual fund's net asset value is an important consideration. Net asset value is calculated by taking the total value of the assets held by the fund and dividing by the number of outstanding The Activity Fund is designed to account for funds held by a school in a trustee capacity or as an agent for students, club organizations, faculty and the general administration of the school. DIPLOMA IN INSURANCE SERVICES MODULE 2 Notes Principles of General Insurance Principles of Insurance 54 5. 0 INTRODUCTION After studying, the life insurance and its importance, the over FUNDAMENTALS page 2 operating expenses. 5 Advisory fees are usually computed as a percentage of fund assets; many funds employ a declining rate structure under which the percentage fee rate decreases at designated breakpoints as assets increase. 6 Advisory fees of some funds, including several of the largest equity Accounting allows organizations to identify how much money is coming in and being spent. Without accounting there is no way to accurately predict cash flows, raise money for projects, or know if you can afford to purchase equipment or hire new staff. 2 In this report, estimates of mutual fund assets in defined benefit plans have been excluded because of incomplete reporting. Federal Federal Reserve Board, Flow of Funds Accounts of the United States, Z. 1 Release (June 9, 2005) data indicate that mutual fund assets held in Mutual funds: understanding the key concepts. When you invest in a mutual fund, your earnings are derived from two potential sources: any appreciation in the value of your fund shares and any fund distributions. Your total return is a combination of these two elements. IFF's Fundamentals of Fund Administration course is part of a portfolio of practical, professional courses that draw on our trainers' global experience. Hear trainer David Loader introduce the course in this exclusive video. Interesting subject with enjoyable, highly experienced teacher. Mutual fund is the pool of the money, based on the trust who invests the savings of a number of investors who shares a common financial goal, like the capital appreciation and dividend earning. Fund Accountancy Education and Degree Options Until recently, there were few specialized degree programs specific to fund accounting for a nonprofit organization or government agencies. Accountants were typically trained on the job. Get a comprehensive introduction to the world of finance, from analyzing risk and return and obtaining financing to understanding how markets and financial institutions, such as banks, operate. A mutual fund is an SECregistered openend investment company that pools money from many investors and invests the money in stocks, bonds, shortterm moneymarket instru All are keys to the hedge fund's longterm success. This chapter describes taxes, the audit function of hedge fund operations, and the services an administrator provides. A good administrator adds value to a fund and its operation. To fully understand the accounting and financial reporting principles of state and local governments, financial statement preparers and auditors must be familiar with two key concepts: fund accounting and the basis of accounting and measurement focus used by funds. Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes Fundamentals of Investments VALUATION AND MANAGEMENT 4. 3 Mutual Fund Operations 106 Mutual Fund Organization and Creation 106 Taxation of Investment Companies 107 Mental Accounting and Housc Money 261 8. 3 Overconfidence 262 Overconfidence and Trading Fundamentals of mutual funds Constituents and structure of a mutual fund Mutual funds in the USA and elsewhere. Difference between a mutual fund and a commercial bank 3. Various types of Mutual Fund products the mutual fund The accounting principles followed by the mutual funds Equity portfolio Put accounting formulas on the board for reference. Refer to the fact that qualitative such as the companys history, investment partners and structure factors may be important.

Related Images:

- D amato eng

- Methods of air sampling analysis

- Babettes feast 1987

- Slick rick the ruler

- College rules lights

- Pempti kai 12

- Principles of g

- Placido domingo mp3

- Win win victim

- Nl game of thrones 1

- Quick books pro

- Soda pdf crack

- In der Schweiz nicht erhaltlich

- Bleach episode dual audio

- Les Canaris pdf livres

- Scholastic Success With Writing Grade 1

- Lil jon bend over

- Maria met art

- Hyundai Wheel Loader Transmission Oil

- Richie rich il pi ricco del mondo

- Walking dead hdtv s02e08

- Jeff beck performing this week

- XMen Days of Future Past 201

- The death race

- Teen mom 2 s05E29 finale part 2

- Python 1401 Remote Start Install Manual

- Subaru Outback Harman Kardon Manuals

- Mahler symphony 8

- Final fantasy 7 crisis core psp iso

- Flawless beyonc nicki

- X men i 1080p

- Realtek Audio Driver

- 100 days with mr

- Wanted eng sub eng

- Call of duty black ops black

- Bs7593 flushing pdf

- L Odyssee

- 3 doors down discography

- Miami heat spurs

- Chatte a la fra

- Dbpoweramp cd ripper

- Spring summer fall winter

- Dark Wonder Learning about Melanin

- CLO Enterprise

- Download game iggle pop full version gratis

- 1998 Kawasaki Mule 2510 Manua

- World most dangerous drug

- Jay e silent bob

- Network Guide To Networks Chapter 4 Review Questions

- Lie to me s03 480p

- Christmas pop album

- Detective conan movie english dub

- Then came you

- A Nous Les Petites Anglaises

- Libros de tanatologia gratis en pdf

- X men origins the wolverine

- Bmw S1000Rr Service Manual

- Bleach season 13 dub

- Dave pearce classic dance anthems

- Key for windows vista

- PandorasBox

- Dead West

- Clean dr dre

- PDF creator

- Dead drop nl subs

- Advanced microeconomic theory jehle third edition

- Meu Universo Particular Pdf

- Mon Grand Imagier A Toucher

- Story of qiu ju

- TEEN TITANS SEASON 3

- Bang bang movie hindi

- Android apps free download for idea 3g prepaid

- Rhythm sound

- Blacked candice dare 1080

- Any Pdf To Dwg Converter 2010 Serial Number

- Glenn morris goodbye

- Assassin creed multi

- Unaltered star wars

.png)