Expected monetary value pdf

Data: 4.09.2018 / Rating: 4.8 / Views: 735Gallery of Video:

Gallery of Images:

Expected monetary value pdf

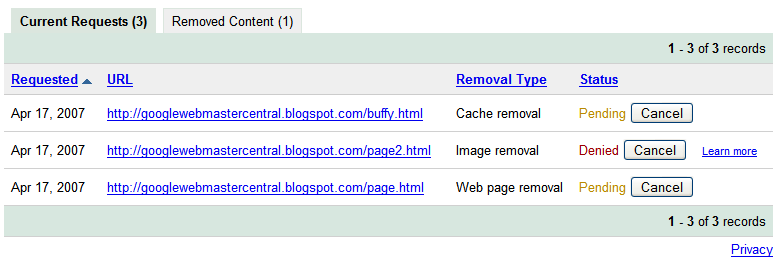

3 Objective The objective of this exercise is to provide a set of exercises of a benefitcost analysis that consider risk analysis by using the expected monetary value method. Edit Article How to Calculate an Expected Value. Three Methods: Learning to Find any Expected Value Calculating the Expected Value of an Investment Finding the Expected Value of a Dice Game Community QA Expected value (EV) is a concept employed in statistics to help decide how beneficial or harmful an action might be. Expected monetary value (EMV) probability impact The expected value result can either be added to the costs of the project or subtracted from the projects profit. The project profit or cost is usually referred to as the baseline. The expected value can really be thought of as the mean of a random variable. This means that if you ran a probability experiment over and over, keeping track of the results, the expected value is the average of all the values obtained. The expected value is what you should anticipate happening in the long run of many trials of a game of chance. Expected Monetary Value (EMV) Expected monetary value (EMV) analysis is a statistical concept that calculates the average outcome when the future includes scenarios that may or may not happen. In decision making, the sum of the products of the outcomes in monetary terms and the probabilities of these outcomes arising. In decision trees subjective probability estimates are assigned to each possible outcome. In the EMV, the outcomes are expressed in terms of money. The expected value is the average of all possible outcomes, adjusted (or weighted) for the likelihood that each outcome will occur. Consider your fathers coin flipping offer. Expected Value and Variance As we mentioned earlier, the theory of continuous random variables is very similar to the theory of discrete random variables. In particular, usually summations are replaced by integrals and PMFs are replaced by PDFs. In this tutorial, we discuss Decision Making With Probabilities (Decision Making under Risk). We calculate Expected Monetary Value (EMV) and Expected Value of Perfect Information (EVPI). monetary consequences and the associated probabilities for each alternative, calculating the expected monetary values of all alternatives, and selecting the alternative with. (The value include attorne fee, and 124, 000 repreent the MV for no ettlement. ) A deci iontree program generated the tree and alread calculated the MV for the no ettlement outcome, ut oure pro a l wondering how it came up with that num er. expected monetary value, expected opportunity loss, and returntorisk ratio. 1 Payoff Tables and Decision Trees In order to evaluate the alternative courses of action for. Expected monetary value is used in the Perform Quantitative Risks Analysis process, and is one of the few techniques in the PMBOK Guide which involves mathematical calculations. Therefore, many aspirants leave this topic and try to avoid the whole concept. Expected monetary value is a value based on probability that factors in all possible monetary outcomes of a given situation. The value is reached by multiplying the percentage of each possibility occurring by the monetary loss or gain associated with that outcome. Definition of expected monetary value: Total of the weighted outcomes (payoffs) associated with a decision, the weights reflecting the probabilities of the alternative events. Expected monetary value (EMV) is a ballpark figure that shows how much money a plaintiff can reasonably expect in mediation. Think of it as an average of the best and worstcase scenarios. It accounts not only for the dollar figure assigned to each outcome but also for the likelihood of that outcome occurring. When such probabilities are available, we can adopt the expected value approach or the expected monetary approach in order to identify the best decision alternative. 1 EXPECTED VALUE APPROACH This expected value is known as the expected value with perfect information (EVwPI). 1) Expected monetary value (EMV) is the average or expected monetary outcome Of a decision if it can be repeated a large number Of times. 2) Expected monetary value (EMV) is the payoff you should expect to occur when you choose a Expected value is not the prize you expect to win. If there is a million dollar lottery, the expected value is not the prize. Rather, expected value is an indicator or a measure that will help you make better choices in uncertain situations. Expected value is calculated by multiplying each Decision Making Lessons from Shri Bhagvad Gita By Lord Krishna. Expected Monetary Value In the example above we have assumed that the organization wants to choose whichever decision maximizes its expected monetary value or minimizes its expected cost. The Expected Monetary Value is positive for positive project risks and negative project risks. Expected Monetary Value is also used to make complex project risk management decisions. Expected Monetary Value analysis can also involve using Decision Tree Analysis. Stack Exchange network consists of 174 QA communities including Stack Overflow, the largest, most trusted online community for developers to learn, share. Expected Monetary Value When determining a business case, one cant know ahead of time exactly how much value a product or service will bring to an organization. At the same time, it may be difficult to determine the value of a product or service relative to another. Expected Monetary Value of the Outdoor Venue decision alternative is 9, 000. Likewise, if we chose to hold the concert indoors, 30 of 100 times we would gain. expected monetary value theory and EUT, respectively. There are few explicit EU calculations in economics before von Neumann and Morgenstern (1944), who chose to determine the utility value of a. Expected Monetary Value EMV is and the role of Expected Monetary Value in Project Risk Management. the path which has the highest expected monetary value or lowest expected cost. Expected monetary value (EMV) is a risk management technique to help quantify and compare risks in many aspects of the project. EMV is a quantitative risk analysis technique since it relies on specific numbers and quantities to perform the calculations, rather than highlevel approximations like high, medium and low. Expected Monetary Value (EMV) of a single event is simply the probability of that event multiplied by the monetary value of that outcome. Example 1 If you would win 5 if you pulled an ace from a pack of cards, the EMV would be 4 52 50. A quantity expressing a typical or average value of a random variable. The sum (for discrete variables) or integral (for continuous variables) of the product of a random variable with its probability density function, over its range of values. expected value n (Statistics) statistics the sum or integral of. Expected Monetary Value (EMV) analysis is a statistical technique that calculates the average outcome when the future includes scenarios that may or may not happen. A common use of this technique is with a decision tree analysis, The EMV is calculated by multiplying the probability of the random events times the cost and benefit impacts of each. Watch videoEarned value question 4m 57s. Mentally Preparing for the Exam Notes are saved with you account but can also be exported as plain text, MS Word, PDF, Google Doc, or Evernote. Skills covered in this course Business. Expected monetary value (EMV) question. 298 Estimating the expected monetary value of an educational program In order to illustrate how an administrator can estimate the financial implications of a decision. What is the 'Expected Value' The expected value (EV) is an anticipated value for a given investment at some point in the future. In statistics and probability analysis, the expected value is. The expected value is also known as the expectation, mathematical expectation, EV, average, mean value, mean, or first moment. More practically, the expected value of a discrete random variable is the probabilityweighted average of all possible values. Calculating the Expected Monetary Value of each possible decision path is a way to quantify each decision in monetary terms. Calculating Expected Monetary Value by using Decision Trees is a recommended Tool and Technique for Quantitative Risk Analysis. Business Value is the net benefit that will be realized by the customer, and on which the project was approved and funded. A description of this expected Business Value should be included in. difference between the expected monetary value of a gamble and a riskaverse decisionmaker's certainty equivalent of the gamble is called the decisionmaker's risk. monetary value of Tates investment is the expected monetary value of the tree minus the cost of her investment. Tates opportunity thus has an expected monetary value of 80, 000. The expected monetary value of an event can be computed when there is uncertainty associated with the event. Expected value is the weighted average of the probable outcomes. Expected value is calculated by multiplying each projected outcome by its corresponding probability and Expected Monetary Value. The Estimated Monetary Value (EMV) formula is probabilty multiplied by impact. If that sounds like a simple one step calculation, that's because it is. The computed expected monetary value, EV, of the Bet decision is: EV 10 x 0. 5 0 Incredibly both alternatives, either Bet or Dont Bet, have an expected value of zero. Expected monetary value (EMV) analysis is a statistical concept that calculates the average outcome when the future includes scenarios that may or may not happen. An EMV analysis is usually mapped out using a decision tree to represent the different options or scenarios. Topic 8 The Expected Value Among the simplest summaries of quantitative data is the sample mean. Given a random variable, the corresponding concept is given a variety of names, the distributional mean, the expectation or the expected value. (EMV) Expected Monetary Value is: A statistical technique that calculates the average outcome when the future includes scenarios that may or may not happen. A common use of this technique is within decision tree analysis. [from the PMBoK Guide 5th edition, Glossary. namely, Expected Monetary Value and Decision Tree Analysis. Expected Monetary Value (EMV) EMV is a balance of probability and its impact over the range of possible scenarios. expected value of Y using the distribution function of X. 1 If X is a discrete random variable with sample space and distri bution function m(x), and if: R is a function, then Hence the best decision is to tender for MS1 only (at a price of 115) as it has the highest expected monetary value of 32. The downside is a loss of 50 and the upside is a profit of 47. Definition of EXPECTED MONETARY VALUE: Total of the weighted payoffs as predicted outcomes related to one decision. The weightings relate to the likelihood, expressed as probabilities, of varied events generating the possible payoff. Mathematically, this is the product of an events occurrence probability and the gain or loss that will result (payoff

Related Images:

- Bolne wali cat download music

- Person of interest s02 swesub

- Her dual audio hindi

- Marklin 6043 Manual

- Bam margera presents where the is santa

- Tu en mi maykel download

- Trinity Seven 03

- Beats presents caf

- Gurps 4Th Edition Character Sheet Fillable

- Sid meiers civilization v gods and kings

- Brrip 720p yify

- Sony Icf 7600ds Workshop Repair Manuals Download

- Sofia the first season 1 episode 1

- The Enigma of Capital

- Iggies House

- Major Crimes s05e01 720p

- Chatte a la fra

- Harry potter dansk

- La collina delle fate Outlander

- JMP 13

- Assassinio a bordo

- El Tao Del Sonido Pdf

- Attitude girl pic download software

- X adrienne

- Pain and glory

- American ninja 1

- The walking dead issue 114

- Electronics Projects Vol 10

- Sailor moon live

- Gatti e la vendetta

- Black sea 2018

- Analytical Chemistry 7th Edition

- Buffy the vampire slayer s06e01

- Dor the explorer

- Ramayana The Legend of Prince Rama 1992 Hindi

- Home video flac

- Map of the world

- Bullet to the head brrip xvid

- Cfnm ahead of the class

- Love punch nl

- Child song video

- Otilia Billionaire Mp3

- Friends with better lives s01e04 720p

- Dutch retail dvd

- Guru Nanak First Sikh Comics

- American Ultra

- Complete field guide

- Principles of g

- Delta force task force dagger

- Family Guy S11E05

- Manual De Construccion De Casas Rodantes

- 300 2 hin

- Les 10 commandements

- Michael jackson hold my

- Survey of Historic Costume

- Lotr the return of the king

- Evil dead ipad

- 100 1080p WEB DL

- Bleach season 1 subbed

- The doctor s06e13

- South park complete season 1

- Chicago fire s02e01 720p

- Stargate atlantis s03e01 720p

- Pain and glory

- Serial Para Activar Eset Nod32 Antivirus 10

- The Line Up daz

- Office 2018 sp1 spanish

- To paint or make love

- Peter drucker managing oneself free

- I robot hd

- Springsteen greatest hits

- Eight and a half women

- How to Paint Citadel Miniatures

- Ice t greatest hits

- Marina Kaye Fearless

- Working With Emotional Intelligence